03 Apr pre-election budget – will the tax cuts equal an election win?

Posted at 13:28h

in articles

Tax cuts, major infrastructure projects and healthcare spending were among the big promises made by Treasurer Josh Frydenberg upon announcing his first Federal Budget on Tuesday 2nd April.

With a promise to deliver a $7.1 billion “surplus” by 2021, this is what Frydenberg’s “Back in Black” budget means for you:

For Businesses

- Eligibility for the instant asset write-off scheme extended to businesses with a turnover of up to $50 million

- Instant asset write-off threshold set to increase from $25,000 to $30,000

- Proposed Division 7A (private company loans) amendments set to be deferred for another 12 months

- $1 billion in funding over 4 years towards the operations of the Tax Avoidance Taskforce targeting multinationals, large public and private groups, trusts and high wealth individuals.

For Individuals

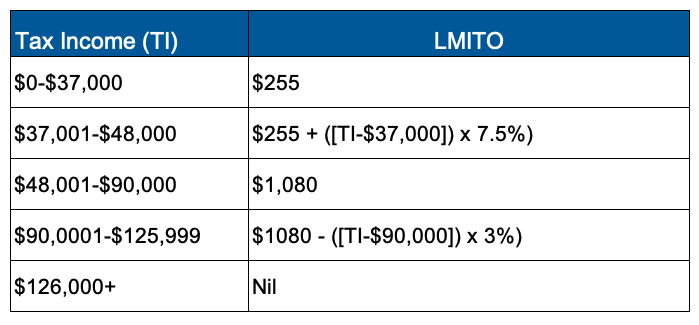

Low and Middle Income Tax Offset (LMITO)

- $158 billion promised for personal taxation relief through the non-refundable Low and Middle Income Tax Offset (LMITO) as per the following:

- Tax offset of up to $255 for taxpayers with taxable income of $37,000 or less

- Taxable incomes between $37,001 to $48,000 eligible to the offset at a rate increasing from 7.5 cents per dollar to the maximum offset of $1,080

- Individuals with taxable incomes between $48,001 and $90,000 set to be eligible for the maximum LMITO of $1,080

Proposed Income Tax Rates

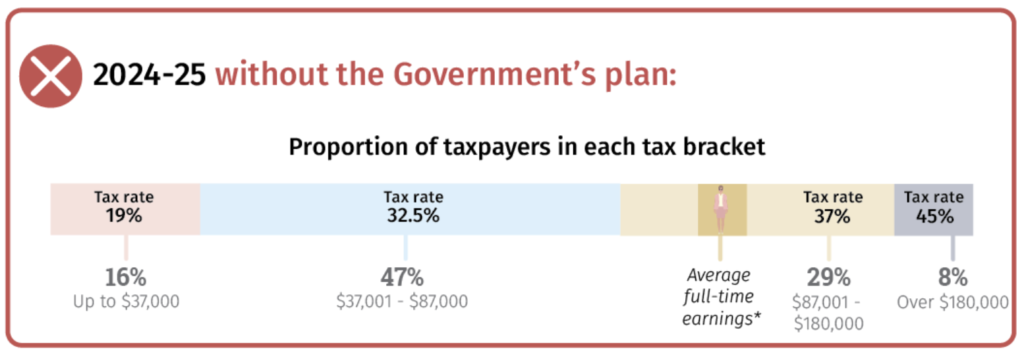

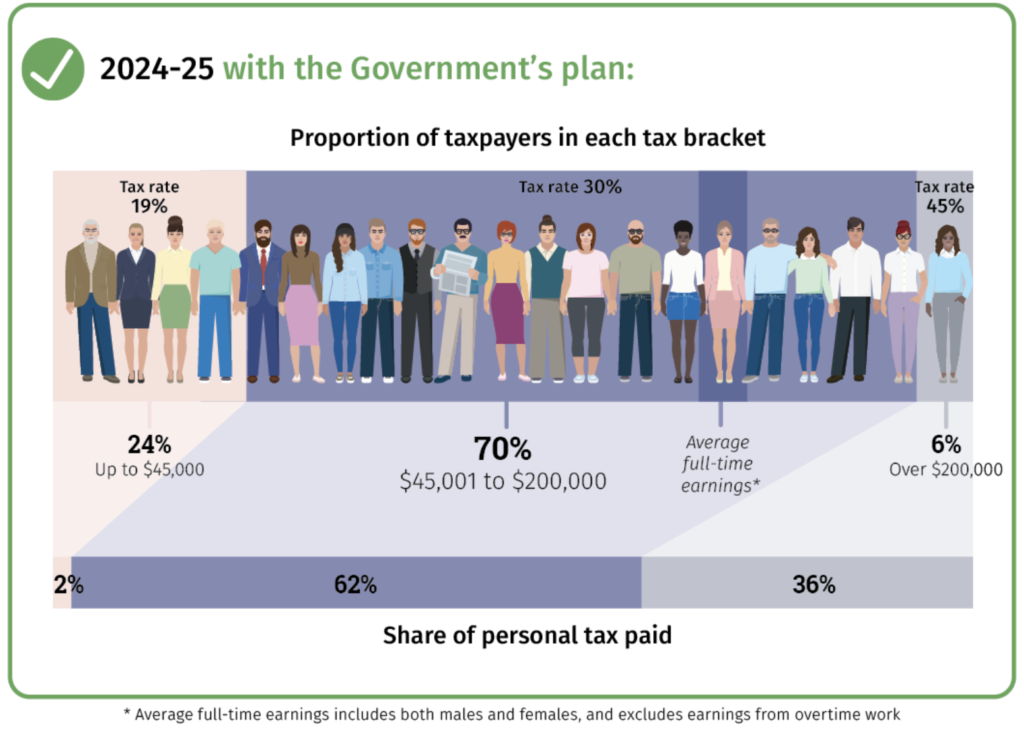

- Proposed Income Tax Rates from 2024-25 will reduce from four income brackets to three:

- 19 cents in the dollar: up to $45,000

- 30 cents in the dollar: between $45,001-$200,000

- 45 cents in the dollar: over $200,000.

Sourced from Budget Paper 2019

Sourced from Budget Paper 2019

Superannuation

- Individuals aged up to 66 set to be eligible for exemption from the Super contribution work test allowing voluntary concessional and non-concessional contributions.

- This will bring the work test in line with the eligibility requirements for the Age Pension, which is set to increase to 67 from 1 July 2023.

Infrastructure

- $100 billion in spending has been promised over the next 10 years to align with the projected growth in population.

- What this means for you in Queensland:

- Additional $2.6 billion promised for projects including upgrades to the Gateway Motorway; and Logan Motorway.

Healthcare

- $81.8 billion pledged toward providing access to essential healthcare and medicines in 2019-20. Among the inclusions in this spending:

- $187 million towards more affordable access to 119 GP services; and

- $331 million towards new drugs to be included in the PBS over five years.

The catch is that the current government must be re-elected at the next Federal election in May. If you wish to discuss how any of these proposed changes may affect you, please contact our tax team.